Dell’s move to take itself private has the tech world buzzing. Our pal TPM dissects the deal here, discussing how much this move is going to cost and where the cash is coming from.

There’s a lot of talk about the motives behind the deal. Some say Dell is doing it to escape the quarterly visit to the Wall Street meat grinder, where either you meet (or exceed) their expectations or get ground into a fine slurry. Going private frees Dell of public reporting requirements and gives them more latitude to acquire, divest, or otherwise remodel the business.

Others say that Dell (the guy) and his partners from the financial industry (Silver Lake, plus others) want to buy the company so they can chop it up and part it out. Along the way, they’ll cut costs to the bone so that they can milk every bit of excess cash into their money pails.

We might well see Dell (the company) realign and reset their strategy – but I don’t see Michael Dell savagely pillaging the company that still bears his name.

I also don’t see Microsoft having much influence in Private Dell. Sure, they kicked in $2 billion, but it’s a loan; and unless they’re getting board seats, Microsoft isn’t going to be driving the Dell bus.

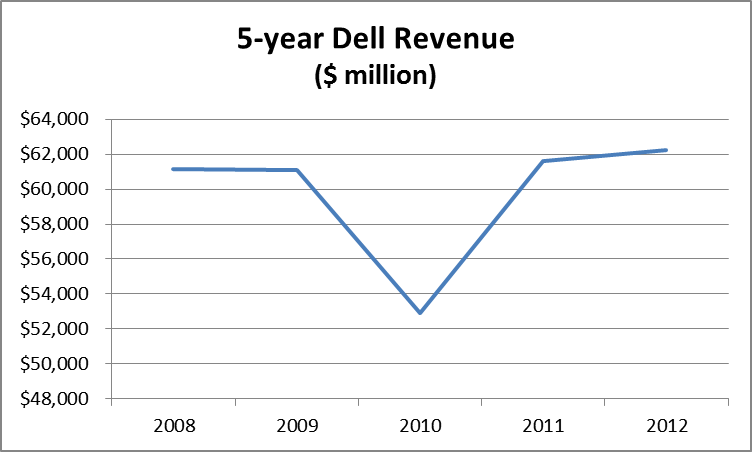

Value and the perception of value is the real reason behind Dell becoming Private Dell. Here’s a look at Dell’s revenue over the past five years. Note the big dip in 2010 – ouch. But also note that revenue in 2012 at $62.2 billion is marginally higher than the $61.1 billion they cash registered in 2008.

So Dell has maintained essentially flat revenue during a worldwide recession, and while PC sales and margins are falling. During this period, they’ve also acquired lots of companies both large and small. This tends to boost revenue but can be a drag on earnings due to integration expenses. But it doesn’t look like this has had much of an effect on Dell’s earnings, as we’ll see on the next chart.

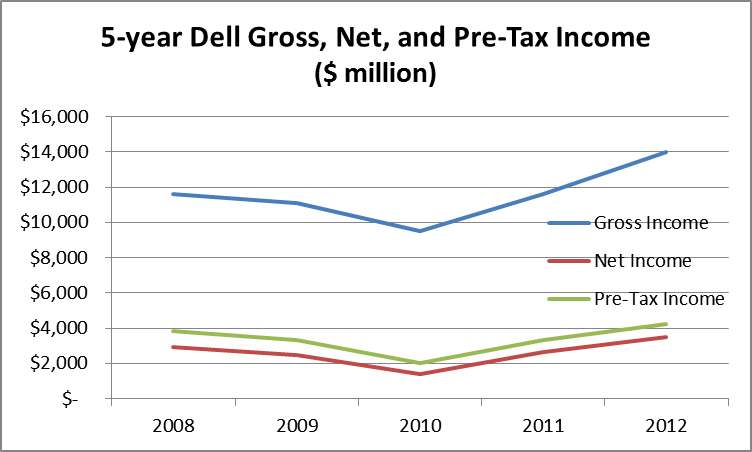

Here’s a look at three different flavors of Dell earnings. The largest is Gross Income, the amount of money left over after you’ve sold stuff and paid for the costs that are directly connected to getting the products placed with customers. Dell’s gross income was $11.6 billion in 2008, dipping down to $9.5 billion in the 2010 trough, but rising to $14 billion in 2012. So Dell managed to increase gross income by more than 20% during a period when revenue was flat – not bad.

We see the same pattern in Net Income and Pre-Tax Income. Both of these numbers drop in 2010 but then rise again in 2012 by about the same amount. Dell’s net income was $2.95 billion in 2008 and $3.5 billion in 2012 – an increase of 18.6%. That ain’t bad at all.

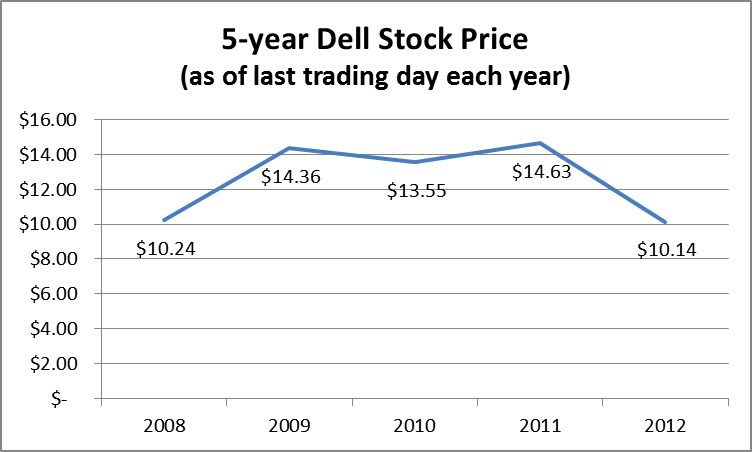

What happened to Dell’s stock price during this period? It was a round trip, closing at $10.24 per share on the last trading day of 2008 and hitting $10.14 the last trading day of 2012. Dell doesn’t pay dividends, so the only return that investors will see is appreciation in their stock price.

Even with Dell (the company and the guy) increasing net income almost 20% in an environment where revenue is flat, the company lost 30% of its value from end of 2011 to the end of 2012. Michael Dell and his partners believe the company is significantly undervalued, and that taking it private is the best way to unlock that value.

Are they correct? Yeah, they probably are. The stock market, particularly with tech stocks, is notoriously fickle and slavishly follows conventional wisdom. Right now, conventional wisdom says that anything associated with PCs is doomed, doomed, DOOMED, and if your products aren’t the fastest-growing entries in the fastest-growing market segment, then your company is a total piece of crap and obviously fit only for the trash heap of history. This view is, to put it charitably, stupid.

Don’t get me wrong. I’m not trying to make the argument that Dell is the best computer company ever. They aren’t. But on the other hand, Dell is profitable, has rising revenues, and tends to be a powerful competitor in the small and mid-sized enterprise segment. If they can put together a solid slate of enterprise products and services, they have a good shot at increasing their share.

There are many investors rolling in money because they invested in unglamorous, but profitable, businesses. Investors in the Dell deal might fall into that category, particularly if they can make the company stronger during the company’s private time, and then re-IPO Dell a few years down the road.